Nonprofit Compliance Requirements and Their Impact

Every Canadian and American compliance officer knows the uneasy feeling when regulatory changes land unexpectedly, disrupting routine and raising questions about current processes. Understanding how to meet complex nonprofit compliance requirements is crucial for maintaining tax-exempt status and public trust. This resource helps clarify the essential rules and responsibilities facing nonprofits, from legal frameworks and financial reporting to ethical governance, so you can guide your organisation with greater confidence and stability.

Table of Contents

- Defining Nonprofit Compliance Requirements

- Key Compliance Categories And Legal Frameworks

- Essential State And Federal Reporting Duties

- Cybersecurity Standards And Data Protection Rules

- Board, Leadership And Staff Responsibilities

- Common Pitfalls And Audit Triggers To Avoid

Key Takeaways

| Point | Details |

|---|---|

| Understanding Compliance | Nonprofits must follow a complex framework of legal and financial requirements to maintain tax-exempt status and public trust. |

| Key Compliance Areas | Important categories include financial accountability, board governance, and adherence to fundraising regulations. |

| Reporting Obligations | Compliance requires meticulous attention to both federal and state reporting duties, including annual Form 990 submissions. |

| Audit Preparedness | Proactively addressing potential audit triggers can safeguard organisational integrity and prevent compliance failures. |

Defining Nonprofit Compliance Requirements

Nonprofit compliance represents a comprehensive framework of legal, financial, and operational requirements that organisations must systematically follow to maintain their tax-exempt status and public credibility. These requirements are multifaceted, encompassing federal and state regulations designed to ensure transparency, ethical governance, and responsible resource management.

At its core, nonprofit compliance involves adhering to a complex set of standards that govern how charitable organisations operate. Regulatory frameworks for nonprofits mandate strict accountability across multiple domains, including financial reporting, board governance, fundraising practices, and programme implementation. Organisations must meticulously document their activities, demonstrate that funds are used for intended charitable purposes, and maintain rigorous internal controls to prevent misuse of resources.

Key compliance areas typically include maintaining 501©(3) tax-exempt status, filing annual information returns like Form 990, ensuring proper financial record-keeping, managing conflicts of interest, and adhering to state-level charitable registration requirements. Nonprofits must also navigate employment laws, data privacy regulations, and ethical standards that protect their beneficiaries and maintain public trust. Comprehensive nonprofit compliance checklist emphasises the importance of proactive governance and continuous monitoring.

Pro tip: Create a dedicated compliance calendar to track critical deadlines for reporting, renewals, and regulatory submissions, helping your nonprofit stay consistently aligned with legal requirements.

Key Compliance Categories and Legal Frameworks

Nonprofit organisations operate within a complex legal landscape that demands comprehensive understanding of multiple compliance categories. Legal governance principles require nonprofits to navigate intricate regulatory environments that encompass financial, operational, and ethical dimensions of organisational management.

The primary compliance categories include financial accountability, which involves maintaining transparent financial records, filing annual tax returns, and ensuring funds are used for intended charitable purposes. Board governance represents another critical category, where nonprofit directors must fulfil fiduciary duties, manage conflicts of interest, and establish robust decision-making processes. Strategic governance frameworks emphasise the importance of creating clear policies that guide organisational behaviour and protect the nonprofit’s mission.

Furthermore, nonprofits must comply with fundraising regulations, employment laws, data privacy standards, and state-level charitable registration requirements. This multifaceted approach requires continuous monitoring and adaptation to changing legal landscapes. Organisations must develop comprehensive compliance strategies that integrate legal requirements into their operational DNA, ensuring ongoing transparency, accountability, and ethical conduct.

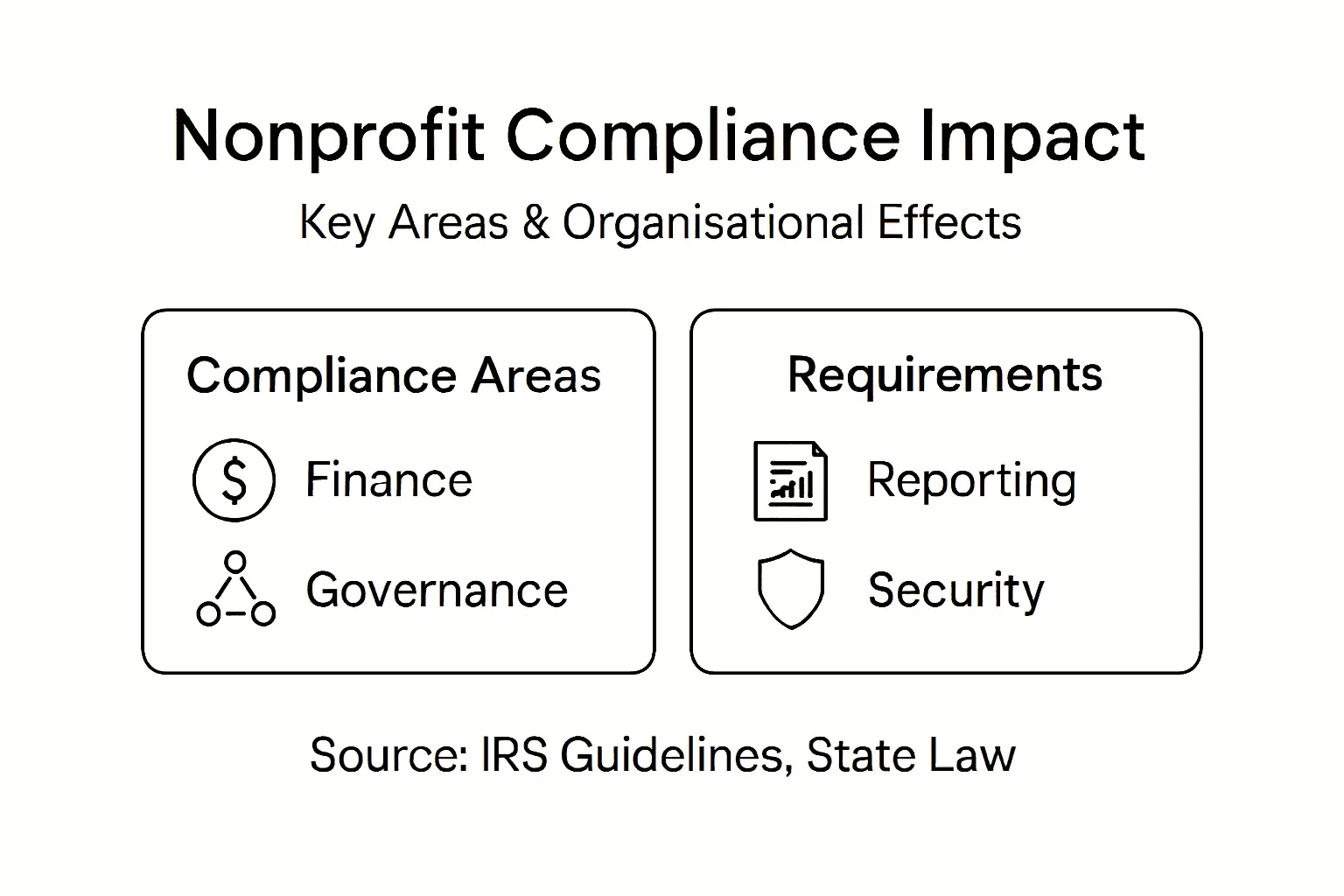

Here is a summary of primary compliance categories and their organisational impact:

| Compliance Category | Key Requirement | Organisational Impact |

|---|---|---|

| Financial Accountability | Accurate reporting & record-keeping | Enhances donor trust and transparency |

| Board Governance | Clear policies & duty fulfilment | Strengthens oversight and reduces risk |

| Fundraising Regulation | Legal registrations & permits | Expands fundraising opportunities safely |

| Data Privacy | Protection of personal information | Safeguards stakeholder relationships |

| Employment Law | Fair contracts & practices | Prevents litigation and reputational harm |

Pro tip: Develop a comprehensive compliance matrix that maps each legal requirement to specific organisational processes, enabling systematic tracking and proactive risk management.

Essential State and Federal Reporting Duties

Nonprofits operate within a complex reporting landscape that demands meticulous attention to both federal and state regulatory requirements. Comprehensive nonprofit reporting checklist reveals that organisations must navigate multiple mandatory filing obligations to maintain their legal and financial standing.

At the federal level, the Internal Revenue Service (IRS) requires nonprofits to submit annual Form 990 series returns, which vary depending on the organisation’s revenue size and operational complexity. These forms provide detailed financial transparency, including revenue sources, programme expenses, executive compensation, and governance practices. Small nonprofits with annual gross receipts under £50,000 can typically file the streamlined Form 990-N electronic postcard, while larger organisations must complete more extensive Form 990 or 990-EZ versions.

State-level reporting introduces additional complexity, with requirements varying significantly across jurisdictions. Nonprofit compliance basics emphasise the importance of maintaining charitable registrations, submitting annual corporate filings, and adhering to state-specific fundraising regulations. Nonprofits conducting fundraising activities must often register in multiple states, requiring careful tracking of solicitation permits, renewal dates, and potential exemptions.

Pro tip: Create a centralised compliance calendar that tracks both federal and state reporting deadlines, with automated reminders and document storage to ensure timely and accurate submissions.

Cybersecurity Standards and Data Protection Rules

Nonprofits increasingly confront complex digital security challenges that demand sophisticated and proactive risk management strategies. Nonprofit cybersecurity guidelines emphasise the critical importance of developing comprehensive digital resilience frameworks that protect sensitive organisational and beneficiary data.

Key cybersecurity standards require nonprofits to implement robust protection mechanisms across multiple domains. This includes conducting regular risk assessments, establishing clear data management protocols, and creating incident response plans. Organisations must prioritise technical safeguards such as multi-factor authentication, encrypted communication channels, and secure cloud storage solutions. Data protection frameworks additionally highlight the necessity of understanding international regulations like General Data Protection Regulation (GDPR), which impacts organisations handling data from European citizens.

Beyond technical implementations, nonprofits must cultivate a culture of cybersecurity awareness. This involves comprehensive staff training programmes, regular security audits, and developing clear policies around data collection, storage, and disposal. Organisations should minimise data collection to essential information, implement strict access controls, and maintain transparent communication about data handling practices to build donor and beneficiary trust.

Pro tip: Develop a comprehensive cybersecurity policy document that outlines specific protocols, staff responsibilities, and step-by-step procedures for preventing and responding to potential data breaches.

Board, Leadership and Staff Responsibilities

Nonprofit organisations rely on a sophisticated governance structure where board members, leadership, and staff each play distinct yet interconnected roles in achieving the organisation’s mission. Nonprofit board governance roles delineate three fundamental fiduciary duties that underpin effective organisational management: duty of care, duty of loyalty, and duty of obedience.

Board members shoulder critical strategic responsibilities that extend beyond routine operational management. Their primary functions include establishing organisational vision, approving strategic plans, ensuring financial sustainability, and providing robust oversight of executive leadership. This includes conducting regular performance evaluations of the chief executive, approving budgets, monitoring organisational financial health, and maintaining legal and ethical standards. Nonprofit board service fundamentals emphasise that board members must act collectively, balancing supportive guidance with appropriate governance boundaries.

Staff and leadership teams complement board oversight by executing strategic plans, managing daily operations, and implementing programmes that advance the organisation’s mission. This requires clear communication channels, well-defined roles, and a shared commitment to transparency and organisational objectives. Effective nonprofits cultivate an environment of mutual accountability, where leadership provides strategic direction and staff translate those strategies into tangible community impact.

Pro tip: Develop comprehensive role descriptions for board members, executives, and staff that clearly articulate responsibilities, expectations, and performance metrics to minimise potential governance conflicts.

Common Pitfalls and Audit Triggers to Avoid

Nonprofit organisations navigate a complex compliance landscape fraught with potential risks that can compromise their operational integrity and tax-exempt status. Nonprofit compliance pitfalls reveal systematic vulnerabilities that can emerge from inadequate financial management, weak governance practices, and inconsistent reporting mechanisms.

Critical audit triggers often stem from financial inconsistencies and reporting errors. These include unreconciled fundraising income, undocumented expense claims, incomplete Form 990 filings, and the presence of unrelated business income without proper classification. Common audit risks highlight that many organisations inadvertently create red flags through poor recordkeeping, lack of financial transparency, and insufficient internal control systems.

Beyond financial considerations, nonprofits must be vigilant about governance-related risks. These encompass conflicts of interest, inadequate board oversight, insufficient documentation of board decisions, and failure to maintain proper separation between board responsibilities and operational management. Organisations must develop robust documentation practices, implement clear conflict of interest policies, and ensure comprehensive training for board members and staff to mitigate potential compliance vulnerabilities.

Compare common nonprofit audit triggers and ways they can be proactively addressed:

| Audit Trigger | Description | Preventive Measure |

|---|---|---|

| Unreconciled Fundraising Income | Income not matched to expenses | Monthly financial reconciliation routine |

| Incomplete Form 990 | Missing or incorrect annual return data | Annual checklist before submission |

| Unclassified Business Income | Revenue outside charitable scope | Clear income stream categorisation |

| Weak Board Oversight | Lack of documented decisions | Formalise board meeting minutes |

| Poor Conflict of Interest Policy | Undeclared interests & decisions | Mandatory annual disclosures by board |

Pro tip: Conduct quarterly internal compliance audits to proactively identify and address potential vulnerabilities before external regulatory reviews occur.

Simplify Nonprofit Compliance and Strengthen Your Organisation Today

Navigating the complex requirements of nonprofit compliance can feel overwhelming from financial reporting to data protection your organisation must stay vigilant across multiple fronts. With the risk of audit triggers and the need for clear governance structures it is crucial to have streamlined management tools that reduce errors and boost transparency. Colossus Systems offers a unified SaaS platform designed to help membership-based nonprofits automate critical processes such as event planning member management and secure payment integration so you can focus on fulfilling your mission with confidence.

Take control of your nonprofit’s compliance challenges now by leveraging our highly customisable solutions that facilitate proactive oversight and seamless communication across your board leadership and staff. Harness tools for advanced member engagement and automated reminders so vital deadlines for financial filings and registrations are never missed. Discover how to reduce administrative burden accelerate organisational growth and safeguard your tax-exempt status today. Connect with us at Colossus Systems Contact Page and start transforming your compliance approach with technology trusted by many nonprofits committed to excellence.

Frequently Asked Questions

What are nonprofit compliance requirements?

Nonprofit compliance requirements refer to the legal, financial, and operational obligations that organisations must follow to maintain their tax-exempt status and public credibility. These include adhering to federal and state regulations on financial reporting, board governance, fundraising practices, and programme implementation.

Why is maintaining 501©(3) status important for nonprofits?

Maintaining 501©(3) status is crucial for nonprofits as it allows them to enjoy tax-exempt benefits and enhances their credibility with donors and the public. It also enables the organisation to receive tax-deductible contributions, which can be vital for fundraising efforts.

What key areas should nonprofits focus on for compliance?

Key areas for compliance include financial accountability, board governance, fundraising regulations, data privacy, and employment law. Nonprofits should ensure transparent financial practices, establish clear governance policies, and adhere to relevant laws to maintain trust and avoid legal issues.

How can nonprofits develop a comprehensive compliance strategy?

Nonprofits can develop a comprehensive compliance strategy by creating a compliance calendar, using a compliance matrix to map legal requirements to organisational processes, and conducting regular reviews and audits. This proactive approach helps ensure alignment with legal obligations and reduces the risk of compliance pitfalls.

Recommended

- Meeting Compliance Requirements: Complete Guide for Organisations|CS

- 10 Best Books for Nonprofit Leaders to Thrive | Colossus Systems

- Workplace Diversity Benefits: Driving Nonprofit Success|CS

- Content Marketing for Nonprofits: Complete Guide | Colossus Systems

- Global Trade Compliance: Streamlining Cross-Border Shipping - ORNER