Secure Credit Card Payment Online: Safer Member Transactions

Security gaps in digital payment systems can put member finances and organisational reputation at risk. For financial officers at membership organisations and nonprofits, adopting secure payment systems is crucial to protect sensitive data and foster trust in every transaction. By understanding the technologies behind online card payments and recognising the strengths of various payment gateways, you can confidently choose solutions that add both convenience and robust security to your e-commerce operations.

Table of Contents

- Secure Online Card Payments Explained

- Types Of Secure Payment Gateways

- Pci Dss Compliance For Organisations

- Key Security Features And Technologies

- Risks, Liabilities, And Mitigation Strategies

- Best Practices To Avoid Data Breaches

Key Takeaways

| Point | Details |

|---|---|

| Secure Payment Systems | Employ advanced technologies like encryption and tokenisation to protect financial transactions from fraud and data breaches. |

| Payment Gateway Types | Understand different payment gateway models to choose the best fit for user experience, control, and security needs. |

| PCI DSS Compliance | Adhering to PCI Data Security Standards is essential for protecting cardholder information and avoiding regulatory penalties. |

| Risk Management Strategies | Implement multi-layered risk mitigation approaches to safeguard against potential digital payment vulnerabilities. |

Secure online card payments explained

Online card payments represent a complex digital ecosystem designed to protect financial transactions from potential security risks. Secure payment systems safeguard sensitive financial information through sophisticated technological infrastructure, ensuring digital transactions remain confidential and protected.

The core mechanics of secure online card payments involve several critical components that work harmoniously to prevent fraud and unauthorised access:

- Encryption technologies that scramble transaction data

- Tokenisation which replaces sensitive card details with unique identification codes

- Multi-factor authentication requiring multiple verification steps

- Secure socket layer (SSL) protocols protecting data transmission

- Compliance with Payment Card Industry (PCI) standards

Each transaction undergoes rigorous security checks that validate the card’s legitimacy and protect the user’s financial details. Digital payment encryption creates multiple protective layers that prevent potential interception or manipulation of transaction information, significantly reducing fraud risks.

Robust security measures transform online payments from vulnerable exchanges to trusted digital financial interactions.

These protective mechanisms ensure that every stage of the transaction - from initial payment submission to final processing - maintains absolute confidentiality and integrity. Financial institutions continuously update these systems to counter emerging cyber threats and protect consumer interests.

Pro tip: Always verify the website’s security certificate and look for “https://” in the URL before entering any payment details.

Types of secure payment gateways

Payment gateway technologies represent sophisticated digital platforms that mediate online financial transactions, enabling organisations to process payments securely and efficiently. These intermediary systems serve as critical infrastructure for digital commerce, connecting merchants, customers, and financial institutions through robust technological frameworks.

The primary types of payment gateways can be categorised into distinct operational models:

- Hosted Gateways: Redirect users to external secure payment pages

- Integrated Gateways: Allow direct transaction processing on merchant websites

- Hybrid Gateways: Combine features from hosted and integrated models

- On-Site Gateways: Provide complete transaction management through merchant-controlled servers

- API-Driven Gateways: Offer customisable integration options

Each gateway type presents unique advantages tailored to different organisational requirements. Online payment processing solutions typically balance critical factors such as user experience, security protocols, and compliance standards to ensure seamless financial transactions.

The table below highlights how different online payment gateway models impact user experience, control, and security for organisations:

| Gateway Model | Merchant Control | Customer Experience | Security Level |

|---|---|---|---|

| Hosted | Minimal | Off-site payment page | High, managed externally |

| Integrated | Moderate | Seamless onsite | Requires merchant upkeep |

| Hybrid | Balanced | Mix of onsite/offsite | Flexible, depends on setup |

| On-Site | Full | Fully integrated | Merchant responsibility |

| API-Driven | High (Customisable) | Tailored experience | Varies by implementation |

Modern payment gateways are not merely transaction processors, but sophisticated security ecosystems protecting digital financial interactions.

The selection of an appropriate payment gateway depends on multiple factors including transaction volume, industry regulations, technical infrastructure, and specific organisational needs. Financial technology continues to evolve, with gateways increasingly incorporating advanced fraud detection mechanisms and machine learning algorithms to enhance security.

Pro tip: Evaluate your organisation’s specific transaction requirements and security standards before selecting a payment gateway solution.

PCI DSS compliance for organisations

PCI Data Security Standard represents a comprehensive framework designed to protect sensitive financial information across global payment ecosystems. This rigorous set of security requirements establishes critical guidelines for organisations handling credit card transactions, ensuring robust protection against potential data breaches and cyber threats.

The key components of PCI DSS compliance encompass several fundamental security principles:

- Network Security: Constructing and maintaining secure network infrastructures

- Data Protection: Implementing strong encryption and data protection mechanisms

- Vulnerability Management: Developing and maintaining secure systems and applications

- Access Control: Restricting system access to authorised personnel only

- Regular Monitoring: Tracking and testing network security continuously

- Information Security Policy: Maintaining comprehensive security documentation

Compliance requirements mandate organisations to develop comprehensive strategies that address multiple layers of technological and procedural security. These standards apply universally, regardless of an organisation’s size or transaction volume, creating a standardised approach to protecting cardholder information.

PCI DSS compliance is not merely a regulatory checkbox, but a critical shield protecting organisational and customer financial integrity.

Successful implementation requires a holistic approach, integrating technological solutions with robust organisational policies. Financial institutions and payment processors must continuously adapt their security frameworks to emerging technological challenges and evolving cyber threats.

Pro tip: Conduct annual comprehensive security assessments and maintain detailed documentation to demonstrate ongoing PCI DSS compliance.

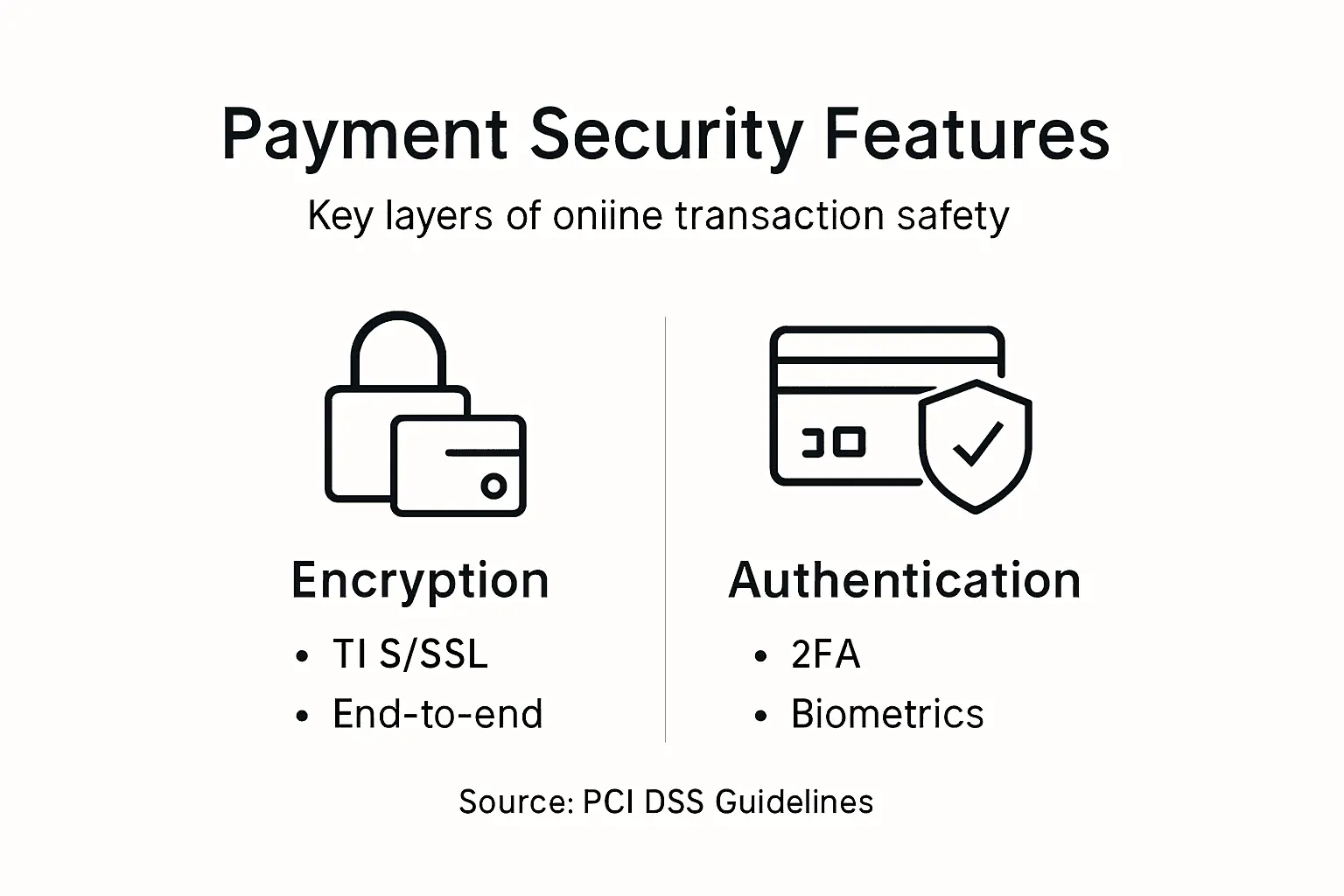

Key security features and technologies

Online payment security systems represent a sophisticated array of technological defences designed to protect financial transactions from potential cyber threats. These multifaceted security architectures create robust barriers against unauthorised access, data breaches, and fraudulent activities across digital payment landscapes.

Critical security technologies include:

- Encryption Technologies: Protecting data through complex cryptographic methods

- Tokenisation: Replacing sensitive financial information with unique digital tokens

- Multi-Factor Authentication: Verifying user identities through multiple independent credentials

- Fraud Detection Algorithms: Utilising machine learning to identify suspicious transaction patterns

- Secure Socket Layer (SSL) Protocols: Establishing encrypted communication channels

- Biometric Verification: Incorporating physical identity markers like fingerprints or facial recognition

Each security feature operates as a sophisticated defence mechanism, creating comprehensive protection strategies that work synergistically to safeguard digital financial interactions. The integration of these technologies ensures that every transaction undergoes rigorous scrutiny before completion.

The following table summarises the organisational impact and business value of key transaction security features:

| Security Feature | Organisational Impact | Value to Business |

|---|---|---|

| Encryption technologies | Reduces data compromise risk | Maintains customer trust |

| Tokenisation | Limits exposure of card details | Facilitates safe recurring billing |

| Multi-Factor authentication | Prevents unauthorised access | Enhances regulatory compliance |

| Fraud detection algorithms | Identifies suspicious behaviour | Minimises financial losses |

| Biometric verification | Enhances identity assurance | Supports seamless user experience |

Modern payment security is not about creating impenetrable walls, but developing intelligent, adaptive defence systems that evolve with emerging technological challenges.

Financial institutions and technology providers continuously refine these security mechanisms, implementing advanced machine learning algorithms and real-time monitoring systems to detect and prevent potential security breaches before they can cause significant damage.

Pro tip: Regularly update your security protocols and conduct comprehensive vulnerability assessments to maintain robust digital payment protection.

Risks, liabilities, and mitigation strategies

Online payment risk management represents a critical framework for protecting financial transactions and organisational reputation in digital payment ecosystems. Understanding potential vulnerabilities enables organisations to develop comprehensive strategies that safeguard both financial assets and member trust.

Primary risks in digital payment environments include:

- Fraudulent Transactions: Unauthorized purchases using stolen credentials

- Chargeback Risks: Financial losses from disputed transaction claims

- Data Breach Vulnerabilities: Potential exposure of sensitive financial information

- Compliance Violations: Regulatory penalties for inadequate security protocols

- Identity Theft Opportunities: Potential exploitation of personal financial details

- Phishing and Social Engineering: Manipulative tactics targeting financial systems

Comprehensive risk mitigation strategies demand a multi-layered approach that combines technological solutions, employee training, and continuous monitoring. Successful risk management requires proactive identification of potential threats and implementing adaptive security mechanisms.

Effective risk management transforms potential vulnerabilities into opportunities for enhanced organisational resilience and member confidence.

Financial institutions must continuously evolve their risk management frameworks, integrating advanced machine learning algorithms, real-time transaction monitoring, and comprehensive employee training programmes to stay ahead of emerging digital threats.

Pro tip: Develop a dynamic risk assessment protocol that includes regular security audits and immediate response mechanisms for potential financial vulnerabilities.

Best practices to avoid data breaches

Cybersecurity protocols represent a critical defence mechanism for protecting sensitive financial information in digital payment environments. Understanding and implementing comprehensive security strategies enables organisations to create robust barriers against potential cyber threats and malicious intrusion attempts.

Key best practices for preventing data breaches include:

- Encryption Protocols: Implementing strong SSL/TLS encryption technologies

- Access Control: Restricting system access through multi-factor authentication

- Regular Security Audits: Conducting comprehensive vulnerability assessments

- Employee Training: Developing cybersecurity awareness programmes

- Transaction Monitoring: Implementing real-time suspicious activity detection

- Incident Response Planning: Creating swift breach mitigation strategies

Online payment security measures require a holistic approach that integrates technological solutions with human intelligence. Successful prevention demands continuous adaptation and proactive risk management across organisational systems.

Data breach prevention is not a destination, but an ongoing journey of technological vigilance and organisational resilience.

Financial institutions must prioritise comprehensive security frameworks that balance technological innovation with rigorous compliance standards, ensuring protection against evolving digital threats while maintaining seamless user experiences.

Pro tip: Implement a continuous learning cybersecurity programme that updates staff on emerging digital threats and protection strategies.

Elevate Member Transactions with Secure, Seamless Payment Solutions

The article highlights critical challenges organisations face when managing secure online card payments including fraud prevention, PCI DSS compliance, and the integration of multi-layered security protocols. Membership-based organisations especially need to safeguard sensitive financial data while providing smooth transaction experiences to their members. Common pain points such as unauthorised access, data breaches, and the complexity of managing payment gateways can impede growth and member trust.

Colossus Systems directly addresses these concerns with its all-in-one SaaS platform that not only streamlines member management but also integrates robust, secure payment gateways tailored for membership organisations, associations, and nonprofits. By combining advanced security features with customisable ecommerce tools and seamless event registration, your organisation can confidently reduce risks and enhance member engagement. Secure your financial transactions with sophisticated encryption, tokenisation, and compliance support embedded within your operational workflows.

Ready to transform your member transactions into a secure, effortless experience? Connect with us today at Colossus Systems Contact and discover how our secure payment integration and comprehensive management platform can safeguard your organisation while driving growth. Don’t wait until security risks affect your members — take control now and build trust through technology tailored for your unique needs.

Frequently Asked Questions

What are the main components of secure online card payments?

Secure online card payments rely on encryption technologies, tokenisation, multi-factor authentication, secure socket layer (SSL) protocols, and compliance with Payment Card Industry (PCI) standards to protect sensitive transaction data.

How does tokenisation enhance payment security?

Tokenisation replaces sensitive card details with unique identification codes, limiting exposure of actual financial information during transactions and significantly mitigating the risk of fraud.

What is PCI DSS compliance and why is it important?

PCI DSS compliance is a comprehensive framework establishing security requirements for organisations handling credit card transactions, ensuring robust protection against data breaches and cyber threats while safeguarding customer financial integrity.

What are some best practices to prevent data breaches in online payments?

Best practices for preventing data breaches include implementing strong encryption protocols, conducting regular security audits, restricting access through multi-factor authentication, providing employee training on cybersecurity, and having a robust incident response plan.