Understanding Online Payment Security: Essential Insights

Online payments have become second nature and millions of transactions pass through digital channels every minute. Yet phishing and spoofing attacks hit nearly 200,000 people in 2024 alone according to FBI reports, and the stakes have never been higher. The real surprise is that advanced cybercriminals now use techniques that go far beyond simple scams and can target entire payment infrastructures before most people even realise what is happening.

Table of Contents

- What Is Online Payment Security And Why Is It Important?

- Key Concepts In Online Payment Security: Encryption And Authentication

- Common Threats To Online Payment Security And Their Impact

- How Does Online Payment Security Work In Real Transactions?

- Best Practices For Ensuring Online Payment Security

Quick Summary

| Takeaway | Explanation |

|---|---|

| Implement multi-factor authentication | Using multiple verification methods enhances security against unauthorized access during transactions. |

| Adopt encryption technologies | Encryption converts sensitive information into unreadable formats, protecting data from cybercriminals. |

| Monitor transactions continuously | Ongoing surveillance helps detect unusual activities quickly, minimizing potential threats to online payments. |

| Educate users on phishing risks | Informing users about phishing tactics helps reduce the chances of financial information being compromised. |

| Establish a solid risk management plan | A comprehensive strategy ensures proactive threat identification and response, safeguarding financial transactions. |

What is Online Payment Security and Why is it Important?

Online payment security represents a comprehensive system of technological protocols, encryption methods, and verification processes designed to protect financial transactions conducted over digital platforms. At its core, this security framework aims to safeguard sensitive financial information, prevent unauthorized access, and mitigate potential risks associated with electronic monetary exchanges.

Understanding the Core Components

Securing online payments involves multiple interconnected layers of protection. The primary objective is to create a robust defence mechanism that shields both consumers and businesses from potential cyber threats. These protective strategies encompass several critical elements:

- Encryption Technologies: Converting sensitive data into complex code that prevents unauthorized interception

- Multi Factor Authentication: Requiring multiple verification steps before transaction completion

- Secure Payment Gateways: Specialised digital channels that validate and process financial transactions

According to the FBI Internet Crime Complaint Center, internet-enabled financial crimes continue to escalate, underscoring the paramount importance of implementing rigorous online payment security measures. In 2024, nearly 860,000 complaints were registered with substantial financial losses, highlighting the urgent need for comprehensive digital protection strategies.

Risk Mitigation and Financial Protection

The fundamental purpose of online payment security extends beyond simple data protection. It serves as a critical mechanism for maintaining trust in digital economic ecosystems. By implementing sophisticated security protocols, organizations can:

- Prevent unauthorized financial transactions

- Protect customer personal and financial information

- Reduce potential financial losses from cybercrime

- Maintain regulatory compliance with data protection standards

Businesses and individuals alike must recognise that online payment security is not merely a technological consideration but a fundamental requirement in our increasingly digital financial landscape. The potential consequences of inadequate security can be catastrophic, ranging from individual financial losses to large-scale systemic vulnerabilities that compromise entire payment infrastructures.

Key Concepts in Online Payment Security: Encryption and Authentication

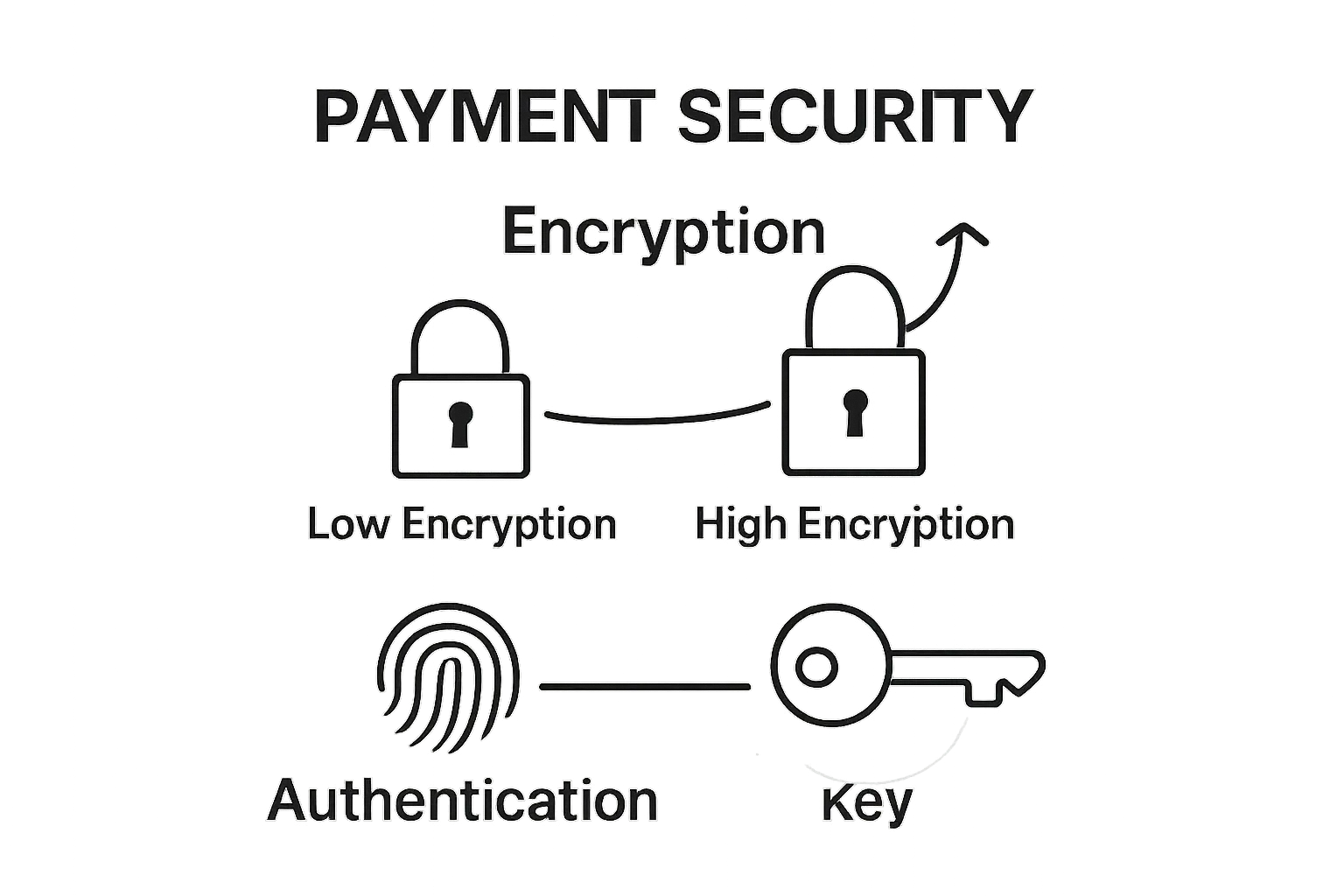

Online payment security relies fundamentally on two critical mechanisms: encryption and authentication. These technological processes work in tandem to create a robust shield protecting sensitive financial information during digital transactions. Understanding their intricate roles is paramount for comprehending how digital financial exchanges remain secure.

To help clarify the distinct purposes and mechanisms, the following table compares encryption and authentication in the context of online payment security:

| Concept | Purpose | How It Works | Key Benefit |

|---|---|---|---|

| Encryption | Safeguards sensitive data during transmission | Transforms data into coded formats using cryptographic algorithms | Prevents unauthorised data access |

| Authentication | Verifies identities involved in transactions | Requires users to prove identity via multiple methods (e.g. biometrics) | Ensures only legitimate access |

Encryption: The Digital Safeguarding Mechanism

Encryption transforms readable data into complex coded formats that cannot be easily understood by unauthorized parties. In online payment contexts, this means converting financial details like credit card numbers, personal identifiers, and transaction specifics into scrambled sequences that appear meaningless to potential interceptors.

The encryption process involves sophisticated mathematical algorithms that:

- Convert sensitive data into unreadable code

- Generate unique cryptographic keys for data transformation

- Ensure only intended recipients can decode the information

According to the National Institute of Standards and Technology, government-level security protocols mandate specific encryption standards to protect digital communications, highlighting the critical importance of these technological safeguards.

Authentication: Verifying Digital Identities

Authentication serves as the gatekeeper in online payment security, verifying that individuals conducting transactions are precisely who they claim to be. This process involves multiple verification layers designed to prevent unauthorized access and potential fraudulent activities.

Modern authentication methods extend far beyond traditional password systems and now incorporate advanced techniques such as:

- Biometric verification (facial recognition, fingerprint scanning)

- Multi-factor authentication requiring multiple identification proofs

- Risk-based authentication analyzing transaction patterns and device characteristics

These sophisticated approaches create dynamic, adaptive security environments that can instantaneously detect and respond to potential security threats, ensuring that only legitimate users can complete financial transactions.

Common Threats to Online Payment Security and Their Impact

Online payment systems face an evolving landscape of sophisticated cyber threats designed to exploit vulnerabilities in digital financial transactions. Understanding these risks is crucial for developing robust defensive strategies that protect both individual consumers and organisational infrastructure.

Phishing and Social Engineering Attacks

Phishing represents one of the most prevalent and insidious threats to online payment security. These malicious techniques involve crafting deceptive communications that trick individuals into revealing sensitive financial information or executing unauthorized transactions. Cybercriminals employ increasingly complex strategies to mimic legitimate communication channels, creating elaborate scenarios that appear genuine and trustworthy.

Typical phishing approaches include:

- Impersonating financial institutions via email or text messages

- Creating fraudulent websites that mirror legitimate payment platforms

- Manipulating users through urgent or threatening language

- Exploiting psychological triggers to prompt immediate action

According to the FBI Internet Crime Complaint Center, phishing and spoofing remained the top reported cybercrime in 2024, with nearly 200,000 documented incidents representing substantial financial risk.

Advanced Cybercriminal Techniques

Modern cybercriminals deploy sophisticated methods that extend far beyond traditional hacking approaches. These advanced techniques involve complex technological infrastructure designed to intercept, manipulate, and exploit digital payment systems.

Key cybercriminal strategies encompass:

- Ransomware targeting payment infrastructure

- Sophisticated malware designed to capture financial credentials

- Cryptocurrency-enabled transaction obfuscation

- Coordinated attacks exploiting system vulnerabilities

These methodologies represent a dynamic and continuously evolving threat landscape that requires constant vigilance and adaptive security protocols. Financial institutions and technology providers must remain proactive in identifying and mitigating potential risks before they can be successfully executed.

The following table summarises some of the most common cyber threats to online payment security, along with their nature and potential impacts:

| Threat Type | Description | Impact on Online Payments |

|---|---|---|

| Phishing | Deceptive messages to trick users into revealing data | Theft of credentials, unauthorised access |

| Social Engineering | Manipulating users via psychological tactics | Compromised accounts, fraudulent payments |

| Ransomware | Malicious software holding payment systems hostage | Disrupted operations, financial losses |

| Advanced Malware | Software designed to capture sensitive financial details | Data breaches, theft of payment information |

| Cryptocurrency Abuse | Obfuscating illicit transactions | Hard-to-trace fraudulent payments |

How Does Online Payment Security Work in Real Transactions?

Online payment security operates through a complex, multilayered system of technological protocols that work seamlessly and instantaneously during digital financial exchanges. This intricate process ensures that every transaction is authenticated, encrypted, and protected against potential cyber threats.

Transaction Initiation and Verification

When a digital payment is initiated, multiple verification mechanisms are immediately activated. The process begins with capturing the user’s payment credentials and subjecting them to rigorous authentication checks. These initial stages involve sophisticated algorithms that analyse multiple data points to confirm the transaction’s legitimacy.

Key verification steps include:

- Matching user credentials against registered account information

- Checking device and network characteristics

- Validating transaction parameters against historical spending patterns

- Implementing multi-factor authentication protocols

According to the National Institute of Standards and Technology, remote user authentication requires comprehensive technical controls that confirm the user’s identity through multiple independent verification channels.

Encryption and Data Protection Mechanisms

Once the initial verification is complete, the transaction enters a secure encryption tunnel. This digital pathway transforms sensitive financial information into complex, unreadable code that can only be decrypted by authorised financial systems. The encryption process happens within milliseconds, rendering the transaction data incomprehensible to potential interceptors.

The encryption methodology involves:

- Generating unique cryptographic keys for each transaction

- Applying advanced mathematical algorithms to scramble financial data

- Creating secure communication channels between payment platforms

- Implementing end-to-end protection throughout the transaction lifecycle

These robust security measures ensure that financial information remains protected from potential cyber threats, creating a safe environment for digital monetary exchanges.

Best Practices for Ensuring Online Payment Security

Ensuring robust online payment security requires a comprehensive, proactive approach that combines technological solutions, organisational strategies, and continuous vigilance. These best practices represent a holistic framework designed to protect financial transactions from emerging cyber threats and potential vulnerabilities.

Authentication and Access Control

Strong authentication mechanisms form the foundational layer of online payment security. Organisations must implement sophisticated verification protocols that go beyond traditional password-based systems. This involves creating multiple barriers that prevent unauthorized access and verify user identities through diverse, interconnected methods.

Key authentication strategies include:

- Implementing multi-factor authentication

- Using biometric verification techniques

- Establishing risk-based authentication protocols

- Creating adaptive access control systems

According to the National Institute of Standards and Technology, organisations should prioritise phishing-resistant authentication methods that provide robust protection against sophisticated cyber intrusion techniques.

Continuous Monitoring and Risk Management

Effective online payment security demands ongoing surveillance and proactive risk management. This involves developing dynamic systems capable of detecting, analyzing, and responding to potential security threats in real-time. Organisations must create adaptive infrastructure that can quickly identify unusual transaction patterns and automatically trigger protective mechanisms.

Comprehensive risk management approaches encompass:

- Real-time transaction monitoring

- Automated anomaly detection systems

- Regular security infrastructure audits

- Comprehensive incident response planning

For membership organisations looking to enhance their online transaction capabilities, exploring advanced store setup strategies can provide additional insights into creating secure digital payment environments.

These strategic practices collectively create a robust defence mechanism that protects financial transactions, maintains user trust, and mitigates potential cybersecurity risks in an increasingly complex digital landscape.

Secure Every Member Transaction with Confidence

Reading about the critical risks and technical safeguards highlighted in “Understanding Online Payment Security: Essential Insights” may leave you questioning if your membership organisation is truly protected against phishing, data breaches, and payment fraud. Unsecured online transactions not only endanger your revenue but also undermine the trust that your members place in you. When it comes to sensitive payment data, there is no room for compromise. Utmost trust comes from using solutions built with strong encryption, real-time monitoring, and layered authentication at every step.

Ready to strengthen your digital payments and protect every transaction? At Colossus Systems, our unified platform integrates secure payment gateways and advanced access management tailored for membership-based organisations. You will benefit from robust security, seamless member experience, and the peace of mind that your financial operations are truly safeguarded. Explore how you can build trust, scale engagement, and drive new growth by safeguarding your digital payments. Visit Colossus Systems now and see how easily your organisation can take the next step towards security and growth.

Frequently Asked Questions

What measures are included in online payment security?

Online payment security includes encryption technologies, multi-factor authentication, and secure payment gateways that protect sensitive financial information and prevent unauthorized access during transactions.

Why is encryption crucial for online payments?

Encryption is crucial as it converts sensitive data into complex codes, making it unreadable to unauthorized users. This protects financial information such as credit card numbers during digital transactions.

How does multi-factor authentication enhance online payment security?

Multi-factor authentication enhances security by requiring multiple verification steps before completing a transaction, ensuring that only legitimate users can access their accounts and conduct financial activities.

What are common threats to online payment security that users should be aware of?

Common threats include phishing attacks, social engineering tactics, ransomware, and advanced malware designed to capture sensitive financial credentials, highlighting the importance of robust security measures.